From the 2024 Government Procurement Winning Projects: Development Trends in Road Lighting Construction

- Share

- From

- www.lightingchina.com.cn

- Issue Time

- Apr 15,2025

Summary

This article filters and analyzes nearly 500 awarded road lighting projects, offering actionable recommendations to provide valuable insights for industry enterprises.

Since last year, policies such as “urban renewal” and “comprehensive rural revitalization” have sent positive signals for the further development of road lighting. According to incomplete statistics, nearly 5,000 government procurement notices related to lighting fixtures were publicly released in 2024, of which approximately 50% involved road lighting. This article filters and analyzes nearly 500 awarded road lighting projects from these notices and explores development trends in road lighting construction, offering actionable recommendations to provide valuable insights for industry enterprises.

Overview of Awarded Projects in 2024

1. Majority of Projects Are Small to Medium-Sized, but Large Projects Account for Over Half of Total Value

In 2024, the total awarded amount of road lighting projects through government procurement exceeded RMB 2.5 billion. The average awarded value per project was approximately RMB 5.5 million, with a median of around RMB 2 million. Although over 70% of the awarded projects were small to medium-sized (below RMB 5 million), projects exceeding RMB 10 million accounted for more than 60% of the total awarded amount. This distribution has become the norm in the road lighting market and is likely to continue in the future.

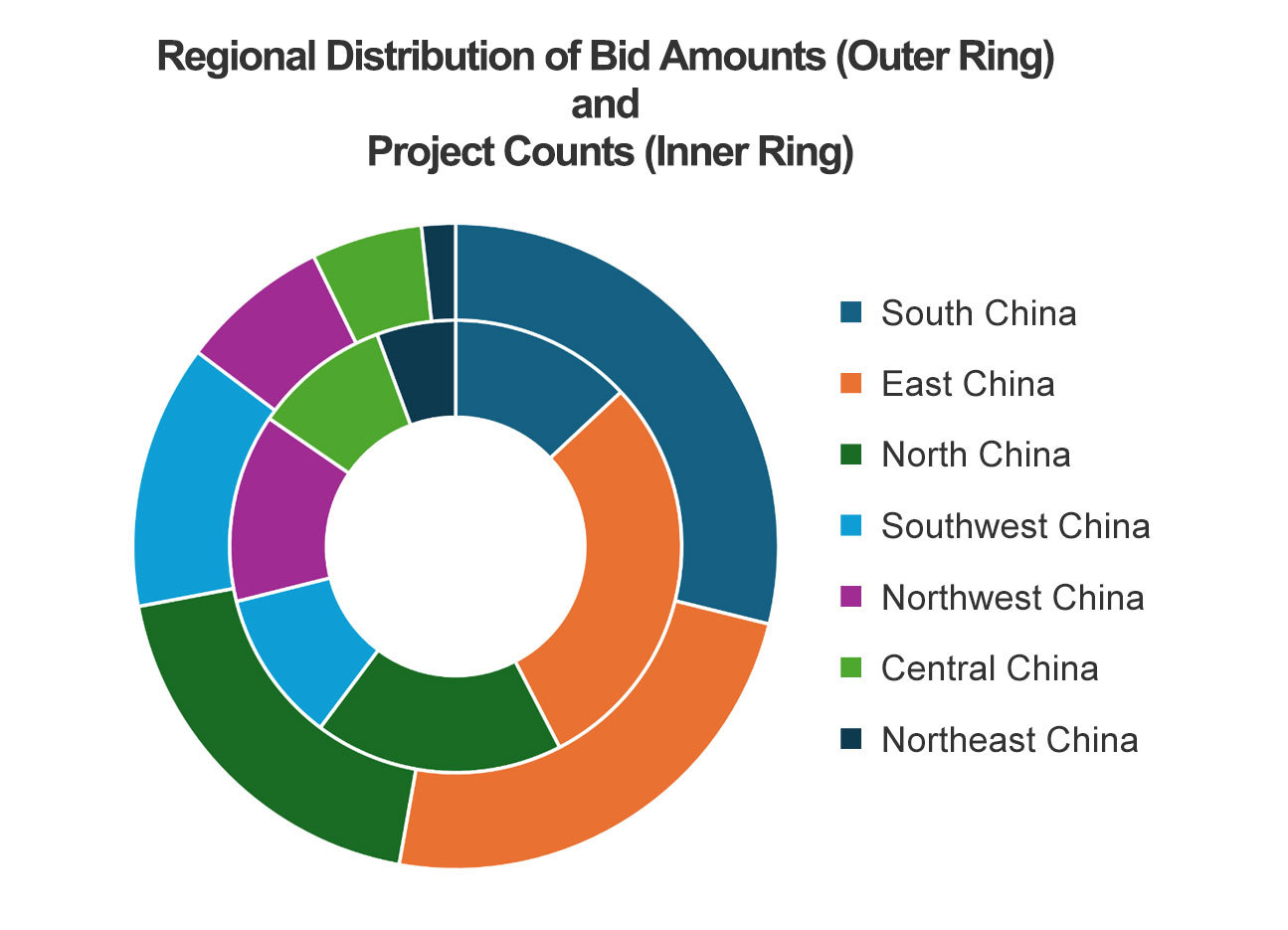

2. Strong Demand in Eastern China, Great Potential in the West

In terms of regional distribution, the eastern coastal areas have the largest number of projects and total awarded amounts. On one hand, these regions have a large base of road lighting infrastructure, generating high maintenance demand. On the other hand, the economic, technological, and social conditions for systematic upgrades are already mature. Urban renewal policies have further driven the demand for quality enhancement.

Meanwhile, the southwestern and northwestern regions show distinct provincial characteristics and hold significant development potential. For example, township-level bidding and rural lighting projects in Xinjiang account for nearly 50% of such projects nationwide. In Yunnan, large-scale urban district lighting renovation projects have emerged. With the continued implementation of national strategies such as the “Belt and Road Initiative,” “High-Quality Development of Western China,” and the “Rural Revitalization Plan,” road lighting projects in these regions are expected to accelerate. Each area will gain more market share through diverse development models and project types.

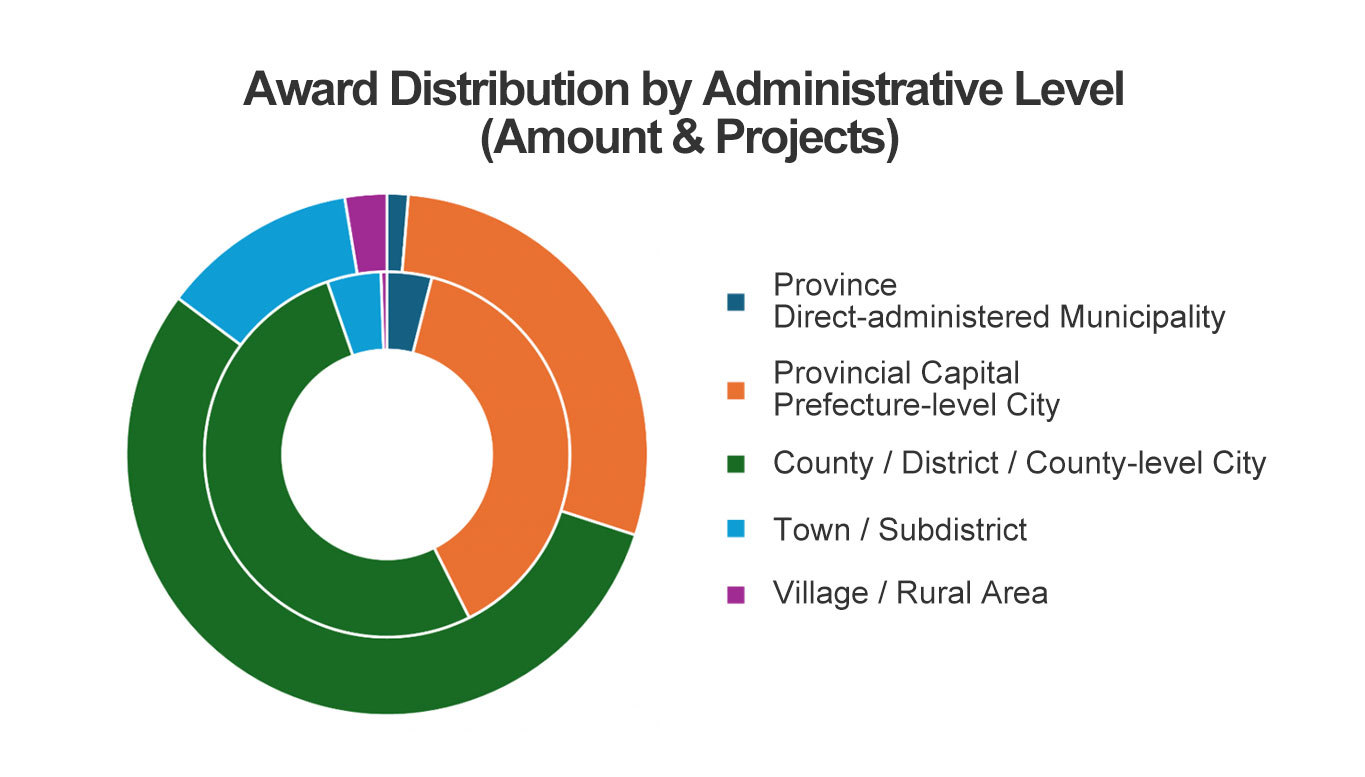

3. Significant Urban-Rural Disparity, Emphasis on District and County-Level Projects

Looking at the tendering entities, in 2024, road lighting projects in urban areas and townships far outnumber those in rural areas, accounting for approximately 97% of the total projects. District and county-level projects have become the main source of projects and funding in the market. With the influence of policies and urban development patterns, the road lighting market is expected to further penetrate into lower levels. Key projects and demonstration projects, which are clearly included in fiscal plans, have vast development potential at the township and even village level.

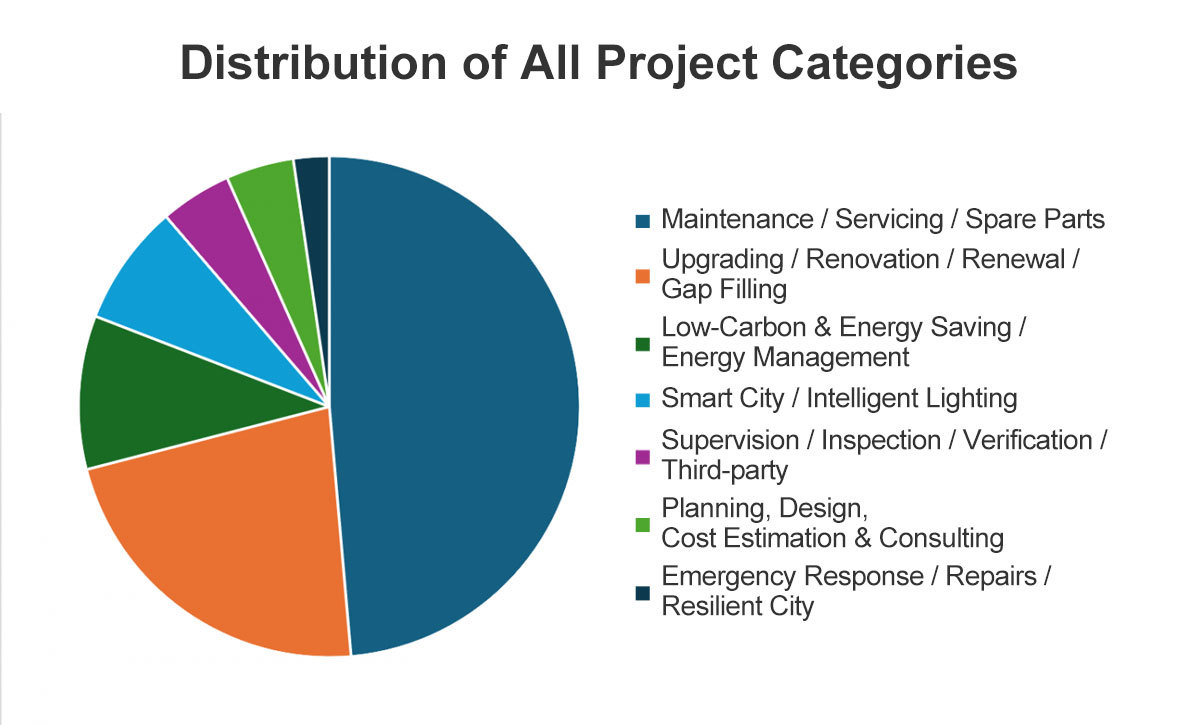

4. Existing Market Focused on Maintenance, with Significant Growth Potential in Energy Efficiency and Smart Solutions

In terms of project types, in 2024, maintenance and upgrade projects account for about 70% of the total, while energy-saving, low-carbon, energy management, and smart city lighting projects represent a smaller share. However, the long-term trend of road lighting moving towards low-carbon and intelligent solutions will not change, and the market capacity will continue to expand. By 2025, road lighting demand will shift towards enhancing quality while ensuring safety and resilience, with a continued focus on green and low-carbon transformation. At the same time, standardized interfaces and modular product designs will improve the efficiency of lighting equipment operation and maintenance. The integration of lighting technology with application scenarios to provide solutions will not only be the future development direction but also reshape the industry's ecosystem.

2025 Trend Analysis and Action Suggestions

1. Stay Aligned with Policy Direction and Grasp Market Trends

Companies should closely monitor national and local policies, as this will not only help identify opportunities for large-scale, high-investment, and high-return projects, but also enable them to accurately grasp market changes and trends. This allows for early strategic planning, R&D preparation, and product, solution, and service competitiveness enhancement.

2. Reserve Innovative Technologies and Promote Integrated Solutions

Low-carbon development is the future direction of road lighting, and smart technologies can bring profit growth. The application of standardized interfaces and modular technologies yields immediate and far-reaching effects. By leveraging external technological tools such as digital city models, drones, and intelligent diagnostics, companies can effectively improve design and operation efficiency.

Businesses should innovate, integrate, and flexibly apply industry chain technologies to create comprehensive solutions. By developing standards, companies can promote widely adopted technologies while setting competitive barriers. Patents should be applied for to protect advanced technological achievements and maintain an industry-leading position.

3. Understand Regional Characteristics and Strengthen Localized Services

The data from 2024 shows that the project characteristics vary greatly across different regions. Companies need to choose and compete in projects based on their specific situations, conducting in-depth research on the road lighting market's current status, needs, plans, goals, economic conditions, budget, and industry chain structure. By tailoring market strategies to local conditions, businesses can promote and develop customized technical solutions for specific applications in their target markets. Efficiently allocating market resources and nurturing the supply chain ecosystem is crucial for success.

4. Collaborate with Institutions and Organizations to Promote Industry Development

Companies should actively collaborate with testing and certification agencies, market regulatory bodies, and industry associations to ensure that their operations and market activities are legal and compliant. Obtaining relevant product and corporate certifications, as well as authoritative evaluations, will help build and continually enhance customer trust, thereby expanding and solidifying their market presence. Industry associations play a key role by organizing standard formulation, scientific assessments, product evaluations, technical seminars, and product launches.

These activities provide businesses with opportunities for government-enterprise communication, industry exchanges, technological positioning, product showcasing, and brand promotion. On top of safeguarding their own interests, companies can help foster mutual benefits and cooperation across the industry chain, contributing to the stability and prosperity of the market.