China Lighting Industry Export Brief – July 2025

- Share

- From

- Sina

- Issue Time

- Sep 10,2025

Summary

Continued front-loading of exports and re-exports, and resilient external demand in non-U.S. markets, overall performance was better than expected.

According to data from the General Administration of Customs, in July 2025, China’s total imports and exports of goods reached RMB 3.91 trillion, up 6.7% year-on-year. Exports amounted to RMB 2.31 trillion, growing 8.0% year-on-year.

Measured in USD, the total trade value was USD 545.3 billion, an increase of 5.9% year-on-year, 4.8 percentage points higher than June. Of this, exports reached USD 321.8 billion, up 7.2% year-on-year, 1.4 percentage points higher than June.

Thanks to the low base effect from the same period last year, continued front-loading of exports and re-exports, and resilient external demand in non-U.S. markets, overall performance was better than expected.

By country and region, China’s exports to the U.S. in July continued their sharp decline, falling 21.7% year-on-year, compared with -16.1% in June, an expanded drop of 5.6 percentage points, dragging down overall export growth by 3.3 percentage points.

Beyond the high base effect from last year, the main factor remains the abnormally high U.S. tariffs on Chinese goods, which still significantly curb market acceptance. In addition, after the China-U.S. Geneva trade talks in May, bilateral tariff cuts triggered a wave of front-loaded shipments and “rush exports” to the U.S., which eased by July.

Meanwhile, exports overall remained resilient thanks to strong performance in non-U.S. markets:

Exports to the EU rose 9.2% year-on-year, up 1.7 percentage points from June.

Exports to ASEAN grew 16.6% year-on-year, only slightly down from 16.9% in June.

Exports to Taiwan, China rebounded sharply from 3.4% in June to 19.2% in July.

Exports to South Korea also recovered strongly, rising from -6.4% in June to +4.6%, a gain of 11 percentage points.

At present, China’s export growth to non-U.S. markets has offset the impact of declining exports to the U.S.

From January to July 2025, China’s total goods trade reached RMB 25.70 trillion, up 3.5% year-on-year. Of this, exports totaled RMB 15.31 trillion, increasing by 7.3%, while imports stood at RMB 10.39 trillion, down 1.6% year-on-year.

From January to July, China’s trade with its largest trading partner, ASEAN, reached RMB 4.29 trillion, up 9.4% year-on-year, accounting for 16.7% of the country’s total foreign trade. Trade with the EU, China’s second-largest trading partner, totaled RMB 3.35 trillion, a year-on-year increase of 3.9%, representing 13.0% of the total. Trade with the U.S., China’s third-largest trading partner, stood at RMB 2.42 trillion, down 11.1% year-on-year, with its share falling to 9.4%.

During the same period, China’s trade with Belt and Road partner countries totaled RMB 13.29 trillion, up 5.5% year-on-year, with its share rising to 51.7%. Meanwhile, China’s exports of mechanical and electrical products amounted to RMB 9.18 trillion, an increase of 9.3% year-on-year, accounting for 60% of total exports.

At present, China’s export growth to non-U.S. markets has offset the impact of declining exports to the U.S.

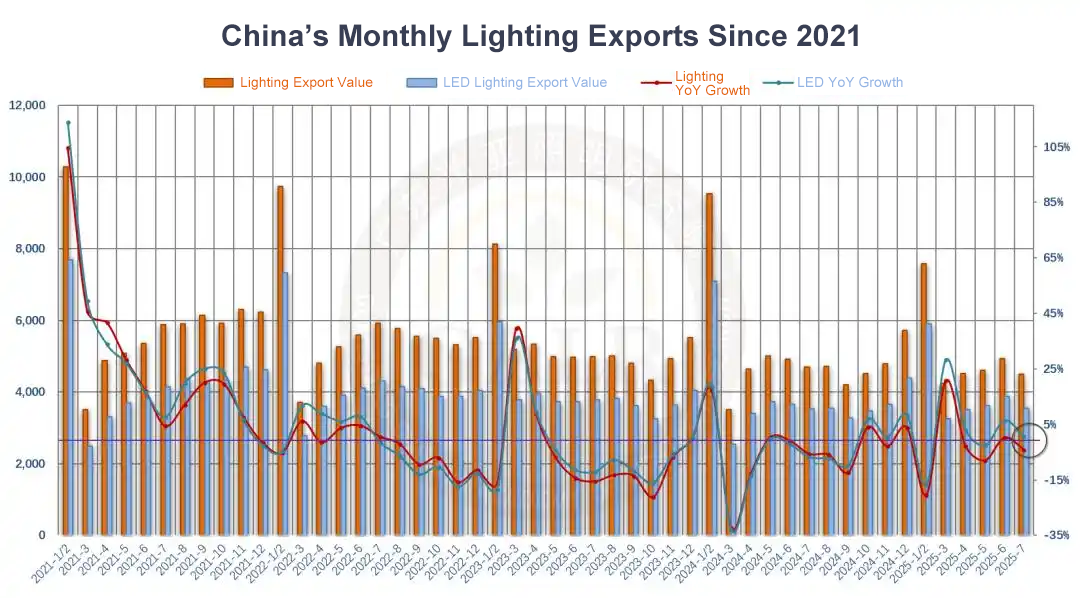

reached USD 4.5 billion, down 4.2% year-on-year, compared with the previous figure of 0.2%, marking a 4.4 percentage point decline. On a month-on-month basis, exports fell 8.6%, versus 7.1% in the prior month. Following the May 12 China-U.S. Joint Geneva Statement on mutual tariff reductions, some enterprises seized the transition period to “front-load exports” and “rush transshipments,” which boosted June’s rebound in export figures but also partially consumed future demand. As a result, this effect naturally weakened in July.

From January to July 2025, China’s lighting product exports totaled USD 30.4 billion, down 6.0% year-on-year, with the decline narrowing by 0.3 percentage points compared to the previous period. In the same period last year, the growth rate was -3.8%.

Among them, LED lighting product exports reached USD 23.7 billion, a slight decline of 0.9% year-on-year, compared to -4.1% in the same period last year, with their share of total exports rising to 78.1%.

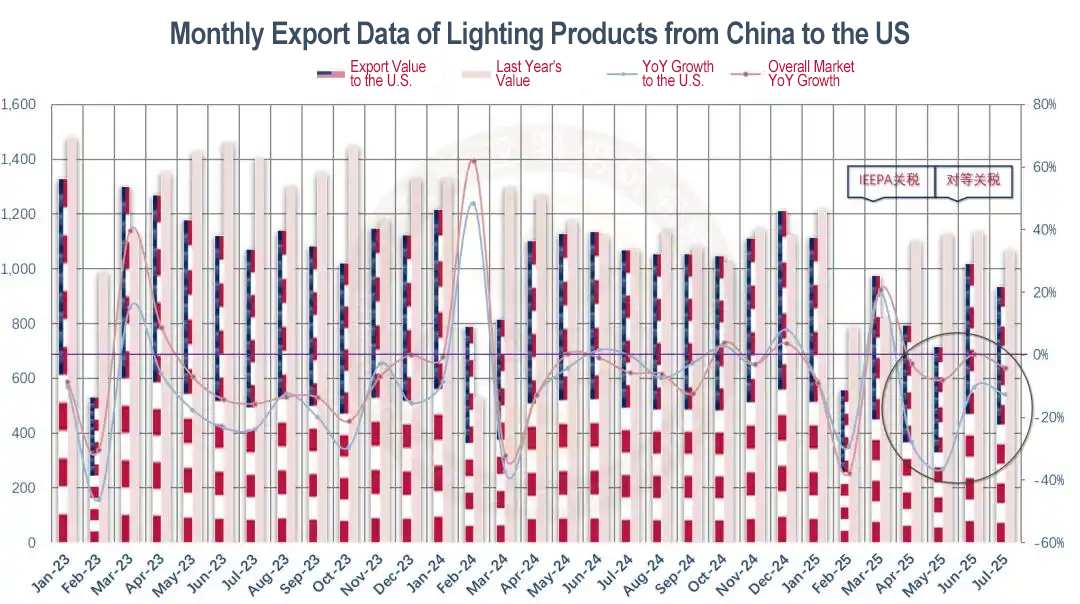

In terms of exports to the United States, China’s lighting product exports to the U.S. in July 2025 reached USD 930 million, down 12.8% year-on-year, with the decline further widening compared to the previous month. On a month-on-month basis, exports fell 8.2%, accounting for 20.7% of total exports. The gap between the U.S. decline rate and the overall market decline expanded to 8.6 percentage points.

From January to July 2025, cumulative lighting product exports to the U.S. totaled USD 6.1 billion, down 15.8% year-on-year, with the share of total exports dropping to below 20%.

On a monthly basis, in January–February 2025, exports recorded the largest decline since March 2024, mainly due to a high base in the same period last year, the impact of the Lunar New Year holiday shift, and the end of the “front-loaded exports” ahead of President Trump’s inauguration. By March, as these temporary disturbances faded, supply-side bottlenecks eased, and tariff impacts had yet to take effect, coupled with a low base from the previous year, export figures rebounded.

Starting in the second quarter, the disruptive effect of reciprocal U.S. tariffs on exports began to emerge. Both April and May registered declines, while June saw a narrower drop thanks to a temporary easing in U.S.-China tariff tensions. By July, however, the weakening of the earlier “front-loaded exports and re-routing” effect led to another downturn.

The current U.S. tariff regime is highly complex, encompassing Section 301 tariffs targeting so-called unfair trade practices, Section 232 tariffs on specific industries, IEEPA tariffs on certain countries, as well as broad-based reciprocal tariffs. Even under the current transitional 10% reciprocal tariff rate, when combined with the still-in-place Section 301 duties and two rounds of IEEPA-specific tariffs, the effective tariff rate on Chinese lighting products remains disproportionately high compared with other economies.