Automotive Lighting Industry: Technological Iteration, Smart Upgrades, and Global Competition

- Share

- From

- Sina

- Issue Time

- Sep 20,2025

Summary

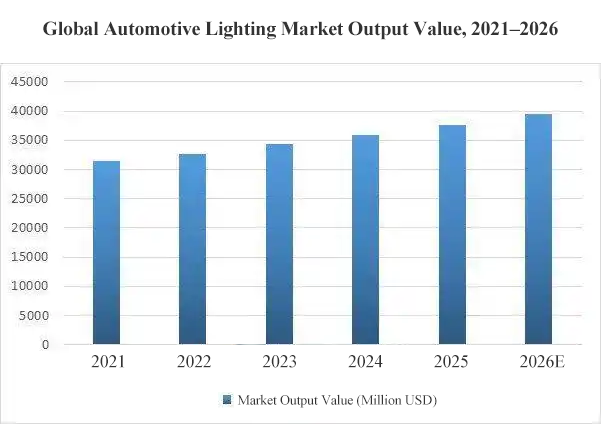

From 2021 to 2026, the global automotive lighting market is expected to expand at a compound annual growth rate (CAGR) of 4.7%, reaching an estimated market size of USD 39.5 billion by 2026

Ⅰ Overview of the Automotive Lighting Industry

(1) Global Automotive Lighting Market Overview

In recent years, driven by the transition of passenger-vehicle energy structures, rapid advances in smart technologies, and the continued penetration of LED solutions, the global automotive lighting market has maintained steady growth.

In the medium term, the gradual adoption of emerging light-source technologies such as OLED, mini-LED, and laser, together with advanced systems like ADB (Adaptive Driving Beam) and DLP (Digital Light Processing), will significantly enhance the intelligence and application scenarios of automotive lighting.

These trends will increase the per-vehicle value of lighting systems. From 2021 to 2026, the global automotive lighting market is expected to expand at a compound annual growth rate (CAGR) of 4.7%, reaching an estimated market size of USD 39.5 billion by 2026.

From a global competitive perspective, the top five automotive-lighting manufacturers in 2024 are Koito, Valeo, Marelli, Hella, and Stanley, together accounting for over 60% of market share, indicating a high industry concentration among leading players.

From a technological standpoint, as requirements for intelligence and safety continue to rise, LED headlights—with their high brightness, low power consumption, long service life, and design flexibility—are steadily increasing their penetration in the global automotive lighting market.

(2) Domestic Automotive Lighting Market Overview

In 2024, China’s automotive lighting market reached RMB 80.9 billion, with an average annual growth rate of about 9.7% over the past four years. Growth has been driven by rising vehicle production and sales as well as higher per-vehicle lighting value—LED headlamp penetration now exceeds 81%, and premium products such as laser headlights are expanding rapidly.

Technologically, LED remains dominant, while laser and Micro-LED innovations are accelerating, and smart functions like ADB (Adaptive Driving Beam) and projection interaction are becoming mainstream trends.

In terms of competition, local leaders such as HASCO Vision and Xingyu Automotive Lighting are gaining share, while foreign players are seeing a gradual retreat. Meanwhile, domestic substitution in the supply chain—covering chips, modules, and equipment—continues to advance.

Policies on energy-efficiency standards and new-energy incentives, together with consumer demand for personalization and aftermarket upgrades, are jointly propelling industry growth.

Ⅱ Future Development Trends of the Automotive Lighting Industry

(1) Rising LED Penetration and the Advent of the “High-Pixel” Era with µAFS and Micro-LED

In the coming years, LED lighting is expected to gain further market share thanks to its strong brightness, long lifespan, and low power consumption. At the same time, the steady evolution and scale-up of autonomous-driving technologies will make high-pixel intelligent automotive lighting and visual-control systems a key development focus.

Smart lighting solutions based on OLED, Micro-LED, µAFS (micro adaptive front-lighting systems), and MEMS (micro-electromechanical systems) are moving from pilot testing toward commercial production. Driven by cutting-edge digital light processing (DLP) innovations, the pixel count of a single headlamp has already surpassed the million-pixel level, signaling that automotive lighting has officially entered the high-pixel technology era.

(2) Growing Adoption of ADB, DLP, and BladeScan to Enhance Safety and Intelligence

Aligned with the Energy-Saving and New Energy Vehicle Technology Roadmap 2.0 vision for “safe, efficient, and smart mobility,” the rising trend of intelligent passenger cars is driving higher requirements for stability, energy efficiency, intelligence, and safety in automotive lighting.

Future systems must enable dynamic light adjustment and predictive driver alerts, pushing control modules toward greater functionality and integration. Adaptive Driving Beam (ADB), Digital Light Processing (DLP), and BladeScan technologies are rapidly penetrating the market. Currently, ADB has about a 9 % installation rate and DLP about 1 % in passenger-vehicle headlamps; by the end of 2025, these figures are expected to climb to 30 % and 5 %, respectively.

(3) Intelligent Interactive Lighting Moves from “Illumination” to “Expression”

With a stronger semiconductor supply chain and rapid shifts in vehicle energy structures, passenger cars are becoming increasingly intelligent. Automotive lighting and visual control systems are evolving beyond traditional illumination and signaling toward emotion-expressive functions.

The product range now spans headlamps, taillamps, ambient lights, welcome lights, and grille lights, while demand for custom designs is rising. Going forward, automotive lighting will reinforce core illumination and signaling functions while emphasizing human–machine interaction, enhancing driving safety, operational comfort, and user delight through intelligent upgrades.

(3) China's R&D and Manufacturing Edge Accelerates Localization

Over the past decade, global automotive lighting was dominated by international players such as Hella (Germany) and Koito (Japan), together holding more than half of the market.

In recent years, however, China’s role in the global auto and components industry has surged, especially in new-energy vehicles, where China has led the world in production and sales for consecutive years.

With a maturing domestic semiconductor supply chain, Chinese automotive-lighting manufacturers are steadily enhancing their ability to integrate hardware and software R&D.

Combined with responsive service and cost advantages, leading local firms—such as HASCO Vision—are breaking through, and the localization of automotive lighting systems in China is expected to accelerate further.

Ⅲ Technical Level and Key Characteristics

Intelligent control, energy efficiency, and enhanced safety have become core development drivers in automotive lighting. Currently, high-intelligence, high-integration, and high-precision smart lighting and vision-control technologies are still largely led by top international players.

After years of growth, China’s automotive-lighting sector has nurtured several strong companies with complete in-house R&D systems and achieved notable breakthroughs in certain high-end technologies.

However, the overall domestic technical level still lags behind that of leading developed countries, leaving room for further advancement.

Ⅳ Competitive Landscape of the Automotive Lighting Industry

The global automotive lighting market is dominated by leading international players such as Koito, Valeo, Marelli, Hella Group, and Stanley, alongside rising Chinese companies like Xingyu Automotive Lighting and HASCO Vision.

In the automotive lamp control module segment, key participants include Keboda Technology, Changzhou Tongbao Optoelectronics, Shanghai Chenlan Optoelectronic Devices, Shanghai Xinyao Electronics, and Jiangsu Xinli Electronics.

Within the automotive lamp manufacturing segment, major domestic firms include Changzhou Xingyu Automotive Lighting, Zhejiang Jinye Auto Parts, and Nanning Liaowang Automotive Lighting.